- -32%

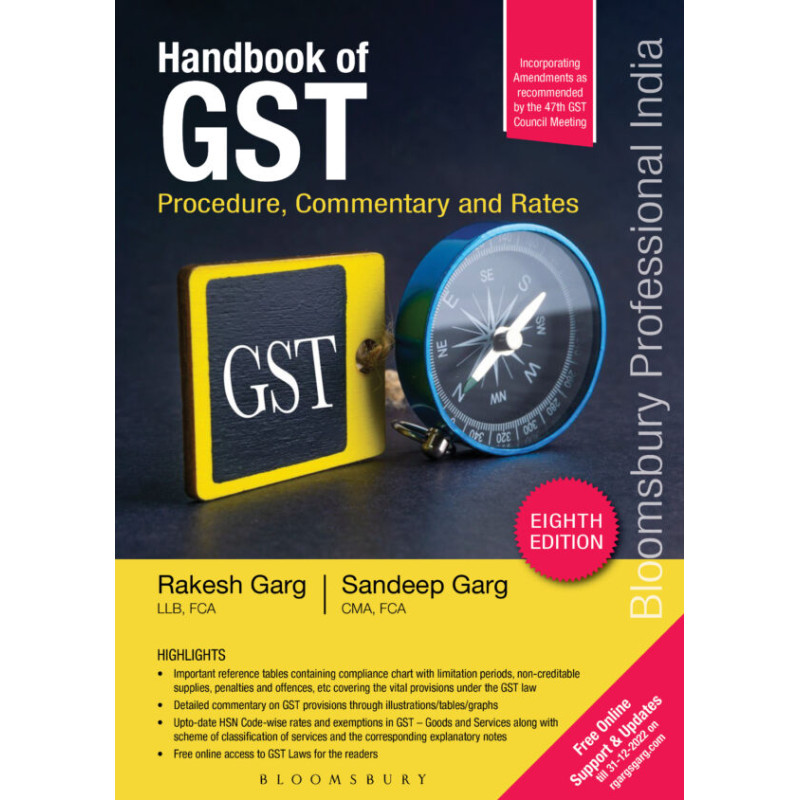

Bloomsbury Handbook of GST Procedure Commentary Rakesh Garg

This book comprehensively discusses various provisions, procedures and compliances prescribed under the GST Laws. It is a very useful handbook for professionals, corporates and regulators, as all the provisions have been explained in a lucid manner.

The book has been divided into three parts.

Part A: Important Reference Tables

Part B: Commentary (Detailed analysis of provisions of GST through illustrations, tables and graphs)

Part C: GST Rates (Comprises of upto date list of GST rates on goods and services)

The book contains:

– Laws as on 01 April 2022

– CGST Act & Rules,

– IGST Act & Rules

– Compensation Cess Act & Rules

– GST Forms

– Scheme of Classification of Services and Explanatory

HIGHLIGHTS

– Important reference tables containing compliance chart with limitation periods, non-creditable supplies, penalties and offences, etc., covering the vital provisions under the GST law

– Detailed commentary on GST provisions through illustrations/tables/graphs

– Upto-date HSN Code-wise rates and exemptions in GST – Goods and Services along with scheme of classification of services and the corresponding explanatory notes

– Free online access to GST Laws for the readers

– Monthly Updates relating to this book upto 31 Dec. 2022, available on rgargsgarg.com